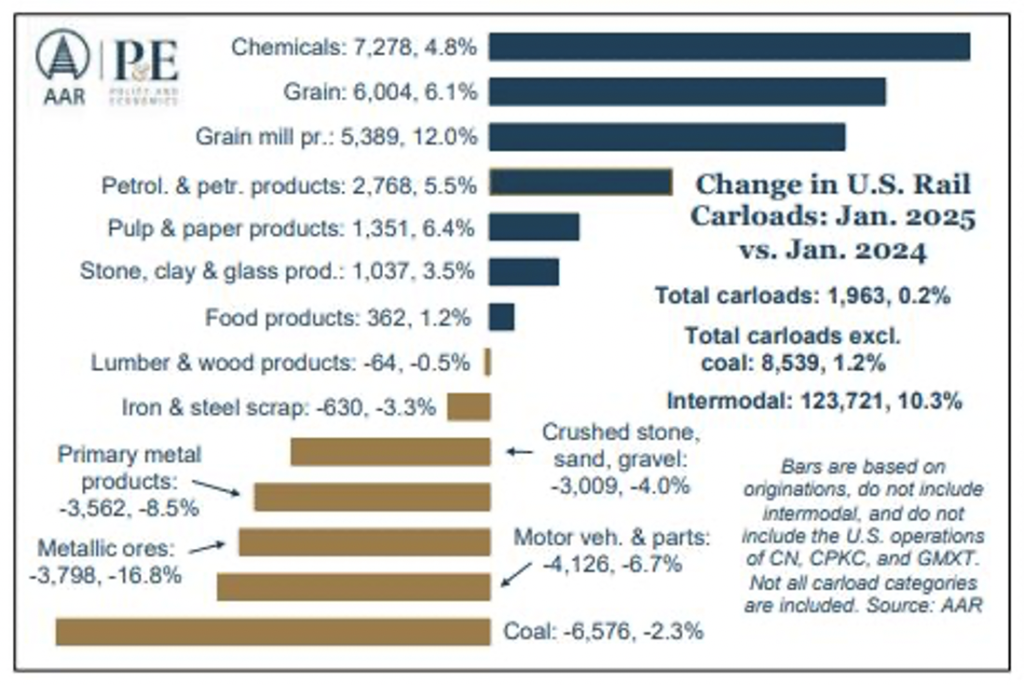

Association of American Railroads produced their first rail industry overview report of 2025. While the numbers are not a complete surprise – there are some alarming findings which we will have to dive into.

The largest increases came Chemicals – as increased chemical production has been fueled by low prices for natural gas, which is used as a feedstock or energy source. Also grain shipments have increased significantly due to strong export demand as grain carloads surged 6.1% in January 2025, marking the 12th straight monthly increase. As well, increased e-commerce and a consistently growing demand for packing materials has led to a 6.4% increase in Pulp & Paper carloads.

The decline in coal and vehicle shipments is because of a number of factors:

- Shift to cleaner energy sources: The ongoing transition away from coal-fired power plants towards renewable energy and natural gas has reduced demand for coal shipments.

- Environmental regulations: Stricter environmental policies may be contributing to the reduced use of coal in energy production.

- Market pressures: Lower natural gas prices and increasing competitiveness of renewable energy sources have made coal less economically viable.

Vehicle Shipments

Consumers are hesitant to purchase new vehicles as the costs have risen substantially in the post covid era.

- The average transaction price for new vehicles in December 2024 was $49,740, compared to $38,948 in December 2019 an increase of nearly 30%

- The rise in prices has been driven supply chain disruptions, raw material inflation, and the semiconductor shortages experienced during the pandemic.

Trade tensions: The ongoing debates about tariffs and trade policies may be affecting cross-border automotive trade, particularly with Canada and Mexico, which are significant partners in the automotive industry. It is also noteworthy that numerous Chinese auto manufacturers have gained a strong market share in Mexico over the last couple of years. Most notably – BYD, who entered the market in 2023 and sold 50,000 cars in 2024, with plans to double sales to 100,000 in 2025. In addition, MG Motor had sales exceeding 60,000 units in 2023.

Despite these declines, it’s worth noting that the manufacturing sector is showing signs of recovery, with the ISM Manufacturing PMI® rising to 50.9% in January, indicating expansion for the first time in 27 months. If this trend continues, it could potentially lead to increased demand for rail-hauled goods, including vehicles in the coming months.